I love The Economist, but sometimes they get it wrong.

Inflation is a very simple thing. You needn't make it more complicated than it already is, because it's not complicated at all, for all inflation is, is a function of two very simple things;

1. How much stuff an economy produces (GDP)

2. How much money its government prints (the Money Supply, or from hence on MS).

You see, the amount of money floating around in an economy REALLY technically doesn't matter. For what truly determines the wealth and standards of living of a nation is the amount of stuff it can produce. Print off all the money you want, so each American has a trillion dollars, that doesn't increase the amount of X-Box's, milk, cars, chocolate, food, jewelry, etc., that we produce. So while you may be excited once you get your trillion dollars, you'll soon realize that ultimately we're not a cent richer as a nation because no corresponding increase in the amount of stuff occured. Alas, we'd just have hyper inflation and the same standards of living.

Now, you'd think this simple truth would have been learned long ago. Ahhh, but never underestimate the power of what I call "The Essence of Socialism;"

You can get something for nothing.

For history is just full of idiots thinking you can get something for nothing, especially by just boosting the money supply. All the way from the ancient Roman Empire in 218AD to just a decade ago in Yugoslavia did idiots who believed in the essence of socialism think their problems would be solved by boosting the money supply.

But please don't think former communist countries and empires long ago are the only ones guilty of such stupidity. Look at America's most stupid decade, the 1970's.

With GDP and MS growth like this;

(Note- "Average MS growth is the average annualized growth rate of the M1, M2 and M3 money supply measures)

(Note- "Average MS growth is the average annualized growth rate of the M1, M2 and M3 money supply measures)How couldn't inflation occur?

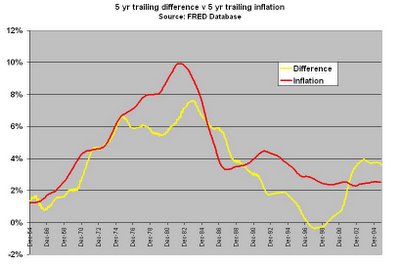

Well, OK, to the untrained eye this tells you nothing because GDP growth and inflation are volatile and erratic. So let's "simplify it up a notch" (got your spice weasel?) and take a 5 year rolling average;

Ahhh, the picture becomes much more apparent. For how couldn't there be inflation in the 70's? You had a money supply growing at an average rate of roughly 9% a year while the economy was only able to produce more stuff at 3% a year.

You may want to chalk up the heady inflationary days to "oil shocks" and "oil embargoes." I chalk it up to stupid politicians, stupid monetary policy and the Baby Boomers who were finally being shepherded out of their parents basement and into the working world to start their job protesting the Vietnam war (surprisingly "protesting the Vietnam War" doesn't contribute to GDP).

Now, notice, rough logic would dictate that if we increase the money supply by 9%, but the economy only grows by 3%, then we should roughly have 6% inflation. ie- the difference between economic growth and money supply growth should give us our inflation rate.

Only one way to tell.

The yellow line is the difference between economic growth (5 yr trailing) and money supply growth (5 yr trailing)

When superimposed on the 5 yr trailing inflation rate;

Well, shucks howdy! Look at that! As far as economics go, that's a perfect fit!

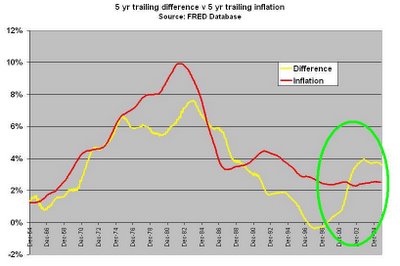

But notice the tail end there, where the difference between the money supply growth and GDP exceeds that of inflation. This is where it gets interesting.

Normally such a divergence would suggest higher prices and thus inflation, yet inflation has remained stubbornly low...or has it?

Normally such a divergence would suggest higher prices and thus inflation, yet inflation has remained stubbornly low...or has it?For you see, the CPI, which is represented by that red line, only includes the prices of consumables. It does NOT include two major asset categories;

Stocks

and

Housing

Notice the increase in the difference between MS and GDP occured in late 1999 and early 2000. Depsite the stock market crash, it was usurped by the housing market where prices have continued to skyrocket.

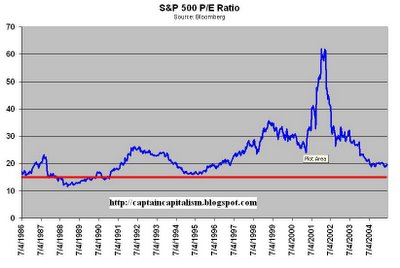

With everybody's money in housing and stocks, it doesn't show up in the CPI measure, but that doesn't mean there isn't inflation. So while the CPI and official inflation has remain relatively tame, stock prices

and property

and property hasn't.

hasn't.Alas, inflation has been with us this entire time, it's just we don't complain about it when the price of our stocks and homes go up.

Now enter in this most recent uptick in inflation.

Here, it is largely due to an increase in oil prices and people are now looking to their central bankers to slay inflation. A sort of "Leftist Syndrome" where people expect somebody else to solve their problems. But I'm not just talking sociology majors that want the government to create jobs so they can do something with their worthless degrees or spoiled brat trust fund babies who expect everything to be taken care of by daddy. We're talking the people at The Economist and the economics profession in general who are in knee-jerk reaction mode;

"Oh, there's inflation? Slay it Greenspan!"

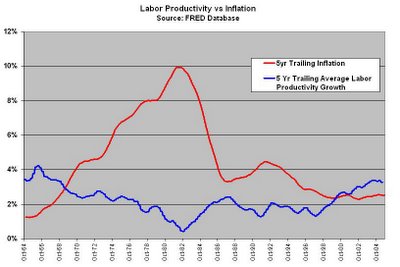

But as a capitalist and a despiser of all things lazy and leftist, need I remind you of the very important lesson we learned above? That inflation is a two-sided equation. It's not just how much money is slushing around in the economy, but how many goods and services we as a nation produce. Notice the relationship between labor productivity and inflation.

A nearly perfect negative relationship, showing that as productivity goes down, inflation goes up (note the chronic deterioration from the mid 60's to the early 80's. Yes, pot, supplanted by cocaine while listening to Jim Moronson may not be good for labor productivity.)

A nearly perfect negative relationship, showing that as productivity goes down, inflation goes up (note the chronic deterioration from the mid 60's to the early 80's. Yes, pot, supplanted by cocaine while listening to Jim Moronson may not be good for labor productivity.)Alas, the fighting of inflation is not solely the responsibility of central banks and central bankers, but by the workers of a country. The central bankers will control the money supply, you the worker, must produce a corresponding amount of goods and services that give reason for such a money supply to exist in the first place.

Thus, fellow countrymen, I say ask not what your central banker can do for you, but what you can do for your central banker.

Now get off your lazy asses and start contributing to GDP!

No comments:

Post a Comment