So I found it interesting when I was cleaning out the house in preparation to move out of the crap hole that is known as the "city" and into those boring, yet low crime and low tax suburbs a couple articles from The Economist I had set aside.

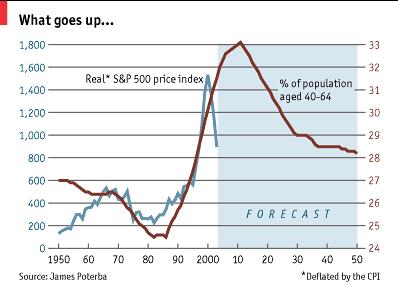

Dated by about 2-3 years, the charts are phenomenal and support my theory that US stock prices are being driven more by retirement cash flows than corporate profits;

Also of concern is the larger and larger percentage the financial sector accounts for in market capitalization, increasing 5 fold since 1980.

But fear not. I'm sure, just like Dotcoms....and Tulip Bulbs...and Beanie Babies...and the South Seas Company...and Indonesia...and the Housing Bubble we're in now, I'm sure, I'M ABSOLUTELY SURE THIS TIME I'M WRONG!

China never looked so good.

No comments:

Post a Comment