Debt is typically the cause of every major recession and depression throughout the history of the world. Through easy credit, people borrow money they can never hope to repay either investing it in foolish things such as Dotcoms or Tulip Bulbs, or perhaps not investing it at all, preferring to do the American thing and buy SUV's, trips to Europe or degrees in philosophy for their spoiled brat children.

This triggers a recession because the funds borrowed could have been lent to the productive members of society and thusly invested in much wiser and productive things, but since they weren't, this results in a decrease in production which is the definition of a recession.

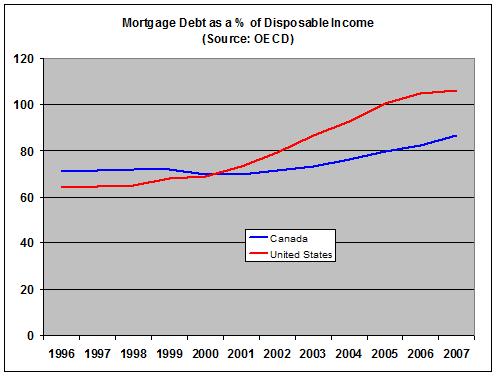

Now I caught a lot of flak for my posting Canada might be a better place to live in the near future, but again, to show that this is not just some whim or me being in a foul mood, take a look at who has been abusing their mortgage debt;

It is an obscure statistic, but mortgage debt as a percent of disposable income is a way to measure how much debt different people in different countries take on relative to the only thing that can pay it back; disposable income. Again, surprise, surprise, our Canadian brothers to the north have taken a more conservative stance and is why they will not suffer as much as their southern neighbors.

The scary thing, is mortgage debt isn't the only kind of debt. There's government debt, corporate debt, student debt, you name it. And when you add it all up, never has the US had more debt relative to GDP (second chart down). And when you look at what we're spending this veritable mountain of debt on (the stimulus, propping worthless auto companies, handouts and welfare) what possible semblance of future production can we expect?

No comments:

Post a Comment