"So, what did you do today?"

You can say with confidence and a smug smile,

"Well, baby, I tested whether or not there is indeed a crowding out effect."

Anyway, for those of you who are not familiar with the crowding out effect it is the theory that when the government borrows all this money to finance federal deficits (like the ones we have now) that means it takes away these loanable dollars from private citizens and business and thereby increases the interest rate.

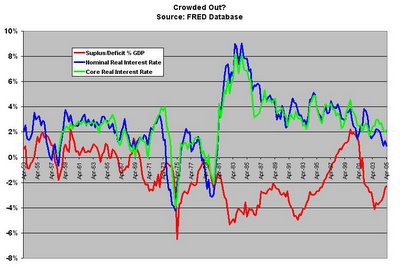

To test this I compared the government budget balance (as a percent of GDP) against the real interest rate of 10 year constantly maturing US Treasuries (ie- took out inflation).

Resulting in this;

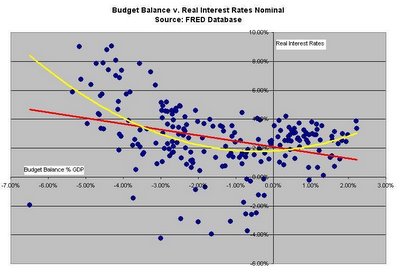

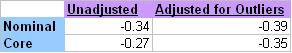

And these correlations/trendlines (10 year interest adjusted for core and nominal inflation);

And these correlations/trendlines (10 year interest adjusted for core and nominal inflation);

Notice with the polynomal trendline there is an uptick in the correlation with budget surpluses and interest rates. It suggests to me that the economy in those periods was growing so fast the natural private sector demand increased interest rates, while at the same time a booming economy resulted in an enlarged tax base increase budget balances into the black.

Notice with the polynomal trendline there is an uptick in the correlation with budget surpluses and interest rates. It suggests to me that the economy in those periods was growing so fast the natural private sector demand increased interest rates, while at the same time a booming economy resulted in an enlarged tax base increase budget balances into the black.

No comments:

Post a Comment