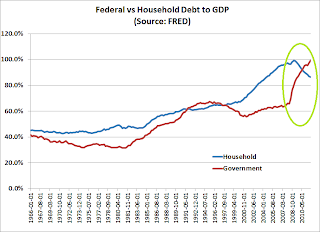

I remember a while ago calculating a chart showing household debt to GDP. This was back in the day when I was lecturing people for spending more than they earned and taking out all the money from their homes. Of course, recessions (coupled now with banks that refuse to lend), have a tendency to make people tighten their belts. The effect is obvious when household debt to GDP went from nearly 100%, down 14% to it's current day (though still-not-eviable) 86%.

You would think the government would do the same. Or, if it were of a particular Keynesian stripe, merely offset this decrease with an increase of 14%. Heck, if you really believe in Keynsianism, you wouldn't need 14%, because of the Magical Economic Farting Unicorn, whose farts bless the land below with it's magical "Multiplier Effect!" THank you Magical Economic Farting Unicorn! So the government would only have to increase spending by 2, maybe 3 percentage points.

No, you foolish, foolish person. The government increased it's debt in the same time by nearly 35%.

Good thing you all tightened your belts and saved so the government could incur $3 more in debt for every dollar you saved!

No comments:

Post a Comment