merger talk circulating around.

I originally invested at 60 cents a share in the hopes that the good socialists of Minnesota would vote for the government to bail them out. Fortunately I got lucky with the merger talk and the same effect occured. But there is something that concerns me and should concern those folks out there getting all giddy thinking NWA will arise from the ashes like a pheonix.

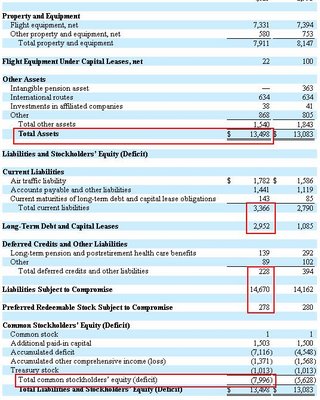

To legitimize the current stock price, a potential suitor would have to offer, at minimum $8.5 billion.

Right now NWA has $8 billion more liabilities than they do assets. So any acquirer of NWA would have to pay that minimum to take the creditors out of the deal. But with 87 million shares outstanding, each trading at $5 per share, this would mean roughly another $500 million would have to be added to the pot to make these shares worth it.

The question is whether NWA is worth $8.5 billion when Delta, a much larger carrier, was just offered $8 billion.

Regardless, I still listen to the investor relations web site of NWA.

No comments:

Post a Comment