" The net flow of current transactions, including goods, services, and interest payments, between countries."

And then they wonder why they don't get dates.

So here is a more real world, simplified application of the current account;

How much more do we consume than we produce as a country.

Or perhaps

How much more do we spend than we earn as a country.

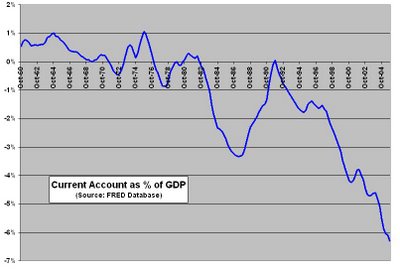

For as Americans have become more lazy and slothful, yet our appetite for SUVs, flat screen TV's, clothes, etc., has not abated, we have to rely on somebody to loan us the money to afford all these things. Thus each year for the past 23 years, we here in America have spent more than we made, and particularly so in the last year, spending a full 6% more than what we produced.

And while we are used to being able to roll over our debts, consolidate them into interest deductible mortgages and refinance at lower rates, that party will surely end soon should even the slightest economic recession hit us as it will be magnified by our gluttonous appetite for debt.

Of course the upside to this is that we nerdy economists who have been paying down our debts, investing in foreign assets and paying cash for our used 1994 Oldsmobile, will all of the sudden become sexy. And the chicks who once chased after Fabio and his 100% leveraged Cadillac Escalade and Interest Only/ARM-financed 4 bedroom house in the suburbs, will become disenchanted with his filing for bankruptcy and be chasing after us for they will appreciate the merits of equity financing...

NAAAAAHHHHHHH!!!!

No comments:

Post a Comment