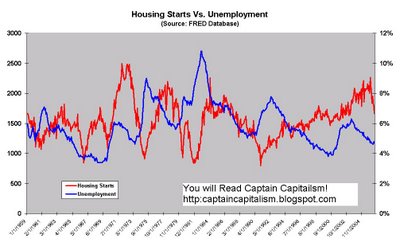

However, it wasn't necessarily the contraction of GDP that tipped me off to the correlation as much as it was how housing starts and unemployment act like a double helix;

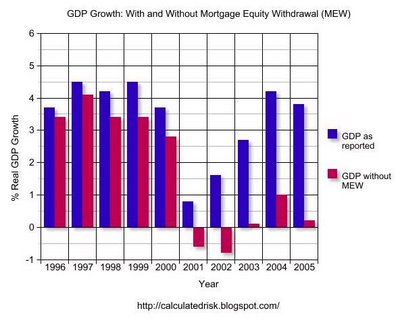

Now there are many things that would suggest to me that we're in for a recession. The obvious correlations above. The fact that consumer spending financed by fat-debt-bloated Americans with their addicted home-equity-loan spending has been having an artifical effect on the growth of the economy (and without perpetually increasing property prices this binge will end).

The utter patheticness of Gen X and future generations insisting on majoring in crap. And let's not forget all of this under the umbrella of constant threats from Muslim nutjobs, with a whimper weak retort from American's "leaders," and the impending social security and medicare crisis.

But it just ain't in my blood. I don't "feel" a recession coming on. It's odd, but contrary to all the mathematical evidence I have, I just got this gut feeling that the economy will be doing just fine for the next 12-16 months.

Alas, perhaps I'm one of the few economists that hasn't had the soul of economics kicked out of me and instead of replacing it with advanced econometrics, statistics, mathematics and models that no matter how complex are still finite, I still have a little faith in chaos, gambling and gut reactions.

No comments:

Post a Comment